Where can I hunt in Berlin?

Berlin has acres located in the South East corner of the city that is called Berlin Wildlife Area. This acreage is available for hunting, subject to all other State Laws and Regulations. A map of the Wildlife Area is available here. Hunters are reminded to be respectful of all private property boundaries when accessing the Berlin Wildlife Area.

Link to Building Inspection and Zoning

When is a permit and inspection needed?

Inspections for the following must be made BEFORE proceeding to the next phase:

- Footings (forms in place, prior to pouring concrete).

- Foundation (drain title and stone in place, insulation if required, prior to back fill).

- Underfloor plumbing (piping installed and on test).

- Basement floor ( vapor barrier, drain tile, and sump crock in place prior to pouring concrete).

- Rough constriction, electrical, plumbing, and HVAC (work completed prior insulation).

- Electrical services.

- Insulation (insulation an vapor barrier installed, before drywall).

- Final inspection (all phases and trades completed, prior to occupancy)

For More information call Building Inspector: 920-210-6351

For Zoning Questions call Zoning Administrator: 920-361-5156

What is CodeRED?

- CodeRED is an emergency notification service by which public safety can notify residents and businesses by telephone or cellular phone about emergency situations.

What kinds of situations will CodeRED be used for?

- Severe weather situations, substantial utility outage, evacuation notices, missing or lost persons, fires or floods, major roadway issues, significant criminal situations, chemical spills or gas leaks. CodeRED can be used for any emergency alert.

How to sign up to receive CodeRED alerts:

- Go to the following website- https://www.greenlakecountywi.gov/departments/sheriff/

- Click on CodeRED Community Notification Enrollment under “Related Links”

- Follow instructions to create an account or proceed to enroll as a guest

- OR download the mobile app on your smartphone

2045 Comprehensive Plan Update

UW-Madison Extension Information about Community Planning:

Introduction

Types of Plans

Preparing for the Planning Process

Steps in a Planning Process

Writing the Plan

Adopting or Amending the Plan

Monitoring and Updating the Plan

Welcome to the City of Berlin’s Comprehensive Plan webpage! From September 2025 and into the next year, we will be updating the Long Term Plan. This plan is like a roadmap for our community’s future, helping us decide on growth, development, and the overall health of our community for the next twenty years. The current plan has been around since 2003, and this update will be designed to reflects our current needs and priorities better and we are open to all feedback the community has to give.

The planning and development team will use this website to share important news about the update process, including opportunities for you to share your thoughts. Make sure to bookmark this page and check back regularly to learn more about how the planning process works.

About the Plan

The City of Berlin is creating a long-term plan that will influence its future for the next 20 years. This comprehensive plan is required by Wisconsin State Statute, which says that local governments must do long-range planning to guide future development and investments that align with community goals.

The plan will focus on nine main areas:

1. Issues and Opportunities

2. Housing

3. Transportation

4. Utilities and Community Facilities

5. Agricultural, Natural, and Cultural Resources

6. Economic Development

7. Intergovernmental Cooperation

8. Land Use

9. Implementation

What can I do if my water or utility bill is extremely high? Can I appeal this amount?

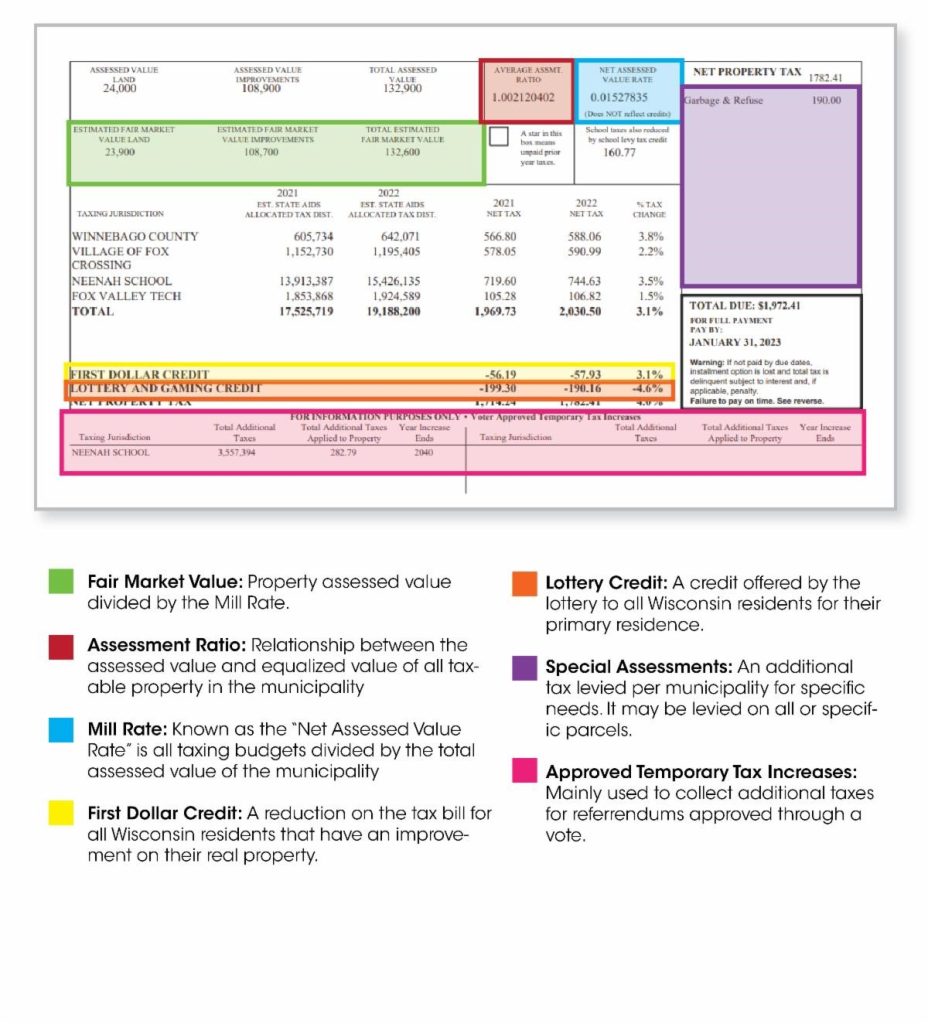

EXPLAINING TAXES AND ASSESSMENTS

Tax bills will be mailed out soon and questions will being to pour in from property owners about taxes. They’ll want to know how taxes are calculated and why taxes are higher this year than last year.

The point of contention between the taxes being collected and the assessment of property has long been misconstrued and overcomplicated. In order to combat these frustrations from property owners, we’ve compiled some quick hitting facts.

First, lets put some things into perspective so we are all on the same page:

- Each community has a unique Mill Rate which is calculated simply by taking all the taxes needed and dividing them by all current assessed values in the municipality. The mill rate is then multiplied by the assessed value to determine an individual tax bill.

- Changes to assessments do not allow taxing entities, like Berlin, to raise their budgets based on increases on assessments. If someone’s taxes increased higher than the average they may have a more desirable home, added or updated the property or have recently purchased the home.

- The City’s piece of the tax pie is only the municipal budget. The other three entities are the school district, the local technical school and the county budgets. Its important to understand that one of those outside budgets may have increased their taxes.

A great resource for FAQ’s can be found on the WCTA website. Check it out: https://wicountytreasurers.com/index.php/faqs/

Below is an example that details the main terms to know when reading a tax bill.

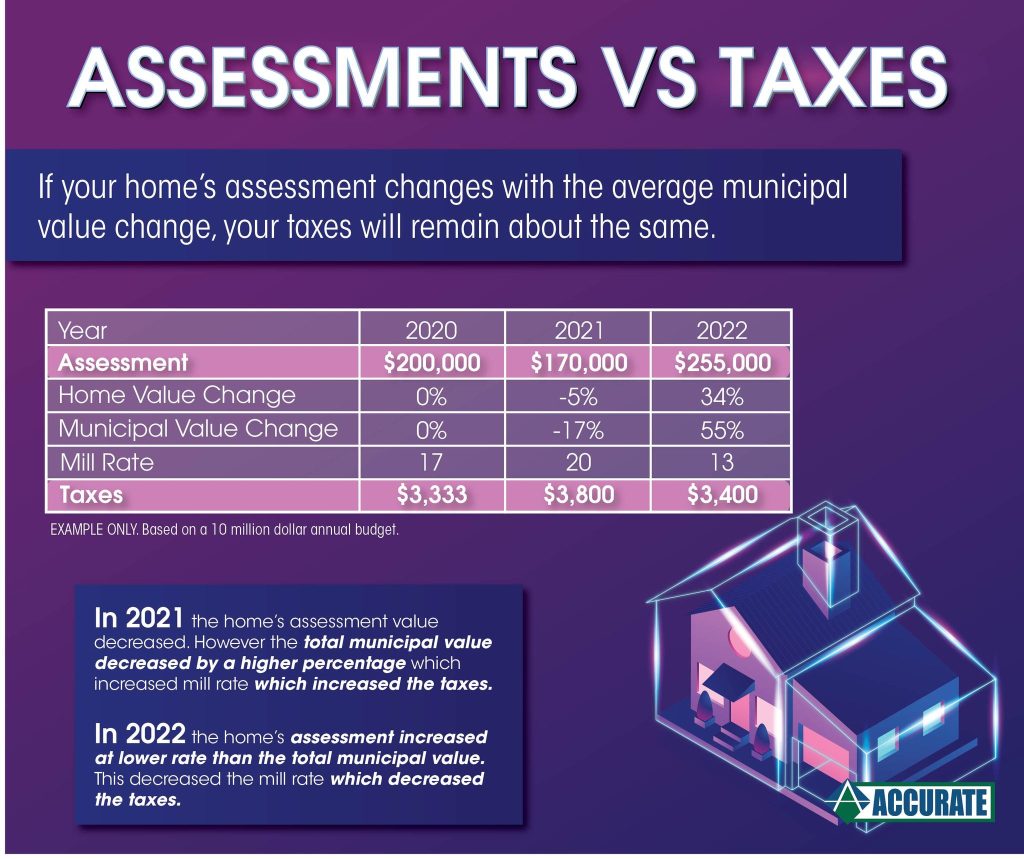

Whether your property assessment increases or decreases, the Mill Rate in your municipality is affected by tax budgets and the total assessed value of your community. As long as your assessment change is close to the community average, your taxes generally stay about the same.

COLOR WHAT DOES IT MEAN

| Yellow | Alliant Energy – Gas |

| Orange | Utility Company – Cable, Phone, or Fiber Optic |

| Blue | City of Berlin Water Department |

| Green | City of Berlin Sewer Department |

| Red | Alliant Energy – Electric |

What is a Wheel Tax?

Wisconsin law allows a town, village, city or county to collect an annual municipal or county vehicle registration fee (wheel tax) in addition to the regular annual registration fee paid for a vehicle. The fee applies to vehicles kept in the municipality or county with:

Autocycle registration

Automobile registration

Truck registration at 8,000 lbs. or less (except dual purpose farm)

This includes most special license plates with autocycle, automobile or truck registration.* State law does not specify the amount of the wheel tax. However, the municipality or county must use all revenue from the wheel tax for transportation related purposes.

*These special plates are exempt from wheel tax: Antique, Collector (“Collector Special” plates are not exempt), Ex-Prisoner of War (if issued without registration fee), Historic Military, Hobbyist and Medal of Honor. All special plates issued to a farm truck, dual purpose farm truck or motor home are also exempt from wheel tax.

What other municipalities/counties have a wheel tax?

Please visit the WisDOT website for a list of current places that have a wheel tax.

What are the typical amounts charged for a wheel tax? How much funding would that provide the City?

Wheel taxes generally range from $15-$40 per vehicle annually, although there is technically no cap to the amount that could be charged. The City Wheel Tax is $25 per vehicle per year. Wheel tax is anticipated to raise about $119,000 on an annual basis. Unfortunately, that amount is not enough to fully fund the City’s road construction needs, but it can be used to supplement and diversify funding of infrastructure maintenance.

When is the fee charged?

WisDOT collects the fee at the time of first registration and at the time of each subsequent registration

renewal. WisDOT sends vehicle registration renewal notices at least 30 days before their plates expire. The

renewal notice will show the total fee due including the wheel tax. WisDOT adds a message to renewal

notices when a new wheel tax is instituted to alert affected customers of the fee change.

Can the revenues received from wheel tax payments be used for any purpose?

Counties and municipalities must use the moneys from wheel tax payments for transportation related

purposes only (s. 341.35(6r), Wis. Stats.). “Highway” is defined by state law to mean “all public ways and

thoroughfares and bridges on the same.” Courts have interpreted “highways” to include trails because they

are “public ways and thoroughfares and bridges on the same.” “Sidewalk” means that “portion of a highway

between the curb lines, or the lateral lines of a roadway, and the adjacent property lines, constructed for use

of pedestrians.”

¿Qué es un impuesto sobre ruedas?

La ley de Wisconsin permite que un pueblo, aldea, ciudad o condado cobre una tarifa anual de registro de vehículos municipal o del condado (impuesto sobre ruedas) además de la tarifa de registro anual regular que se paga por un vehículo. La tarifa se aplica a los vehículos mantenidos en el municipio o condado con:

Registro de motocicletas

Registro de automóviles

Matrícula de camión a 8,000 lbs. o menos (excepto finca de doble propósito)

Esto incluye la mayoría de las placas especiales con registro de motocicleta, automóvil o camión.* La ley estatal no especifica el monto del impuesto sobre las ruedas. Sin embargo, el municipio o condado debe utilizar todos los ingresos del impuesto sobre ruedas para fines relacionados con el transporte.

*Estas placas especiales están exentas del impuesto sobre ruedas: Antiguo, Coleccionista (las placas “Especiales de Coleccionista” no están exentas), Ex-Prisionero de Guerra (si se emite sin cuota de registro), Militar Histórico, Aficionado y Medalla de Honor. Todas las placas especiales emitidas a un camión agrícola, un camión agrícola de doble propósito o una casa rodante también están exentas del impuesto sobre ruedas.

¿Qué otros municipios/condados tienen un impuesto sobre las ruedas?

Visite el sitio web de WisDOT para obtener una lista de los lugares actuales que tienen un impuesto sobre las ruedas.

¿Cuáles son los montos típicos que se cobran por un impuesto sobre ruedas? ¿Cuánto financiamiento proporcionaría eso a la Ciudad?

Los impuestos sobre las ruedas generalmente oscilan entre $ 15 y $ 40 por vehículo al año, aunque técnicamente no hay un límite para la cantidad que se puede cobrar. Si se adopta, el impuesto sobre las ruedas de la ciudad probablemente sería de alrededor de $25 por vehículo por año, pero esa cantidad podría cambiar según la decisión que tome el Consejo Común. Suponiendo un impuesto de rueda de $25 por vehículo por año, la Ciudad recaudaría alrededor de $119,000 anualmente. Desafortunadamente, esa cantidad no es suficiente para financiar completamente las necesidades de construcción de carreteras de la Ciudad, pero se puede utilizar para complementar y diversificar la financiación del mantenimiento de la infraestructura.

¿Cuándo se cobra la tarifa?

WisDOT cobra la tarifa en el momento del primer registro y en el momento de cada registro posterior

renovación. WisDOT envía avisos de renovación de registro de vehículos al menos 30 días antes de que caduquen sus placas. los

el aviso de renovación mostrará la tarifa total adeudada, incluido el impuesto sobre ruedas. WisDOT agrega un mensaje a la renovación

avisos cuando se instituye un nuevo impuesto sobre ruedas para alertar a los clientes afectados sobre el cambio de tarifa.

¿Los ingresos recibidos por el pago del impuesto a las ruedas se pueden utilizar para algún propósito?

Los condados y municipios deben usar el dinero de los pagos del impuesto sobre ruedas para fines relacionados con el transporte.

propósitos solamente (s. 341.35(6r), Wis. Stats.). “Carretera” está definida por la ley estatal como “todas las vías públicas y

vías y puentes sobre el mismo”. Los tribunales han interpretado que las “carreteras” incluyen senderos porque

son “vías y vías públicas y puentes sobre las mismas”. “Acera” significa esa “parte de una carretera

entre las líneas de acera, o las líneas laterales de una calzada, y las líneas de propiedad adyacentes, construidas para su uso

de peatones.”

¿Por qué Berlín busca un impuesto sobre las ruedas?

Berlín está experimentando una crisis financiera. Los costos están aumentando y la Ciudad está tratando de mantenerse al día con las reparaciones y el mantenimiento de las carreteras. Wheel Tax proporciona a la ciudad algunos fondos adicionales para ayudar a compensar los costos. Todo Impuesto sobre Ruedas recaudado debe destinarse a la reparación y mantenimiento de carreteras.